Intro

Ethical ($ETHi) is a project that allows users to participate in a real property transaction on the blockchain in a variety of different ways including exotic arrangements such as a common Lease to Own product. $ETHi is an ERC-20 token that is automated as a smart contract on the Polygon blockchain. ETHi is your ticket into an entire ecosystem of decentralized and peer-to-peer property arrangements involving fractionalized ownership in real estate, funding, development, leasing, and borrowing. We are the first international real estate project on the blockchain where users all over the world can invest in real property without thmiddlemanan fees.

Information and a FAQ is available at www.ethicalijara.com/faq (COMING SOON)

The purpose of this document is to walk through the features of the project and verify or explain them in terms of what the smart contract does. The project founders have provided the developed version of the code to the community via Ethersacan for full transparency.

The ETHi token essentially represents a time deposit. A staking bonus is paid out in the form of additional ETHi tokens, and this staking bonus is variable depending on when the ETHi token is staked and for how long. From time to time the various real estate ventures will determine what the staking bonus is for newly staked or re-staked tokens depending on what the financing needs are for any given project.

Revolutionizing a Global Mortgage Marketplace

Ijara Community Development Corporation (Ijara CDC) is a non-profit entity redefining financial services with a focus on structuring ethical mortgages through transparent management and execution; leveraging blockchain technology as the primary mode of participation. Ethical mortgages are a relatively untapped market that serves a population looking to avoid the traps and opaqueness of traditional mortgage contracts tied to volatile interest rates and allows borrowers to benefit financially from increased tax benefits and longer investment horizons. For decades, Ijara CDC has been the leader in structuring ethical mortgages through its safe and patented process giving consumers the best possible flexibility when comfortable homeownership is the goal and get,ting there means wrestling with the most complex financial contract in existence. Traditional mortgages inspired by the blockchain are here and there is no absence of companies attempting to stake their claim to the industry. Albeit, none of these companies have innovated a system that benefits the homeowner in the way that Ijara CDC has in channeling blockchain technology.

Ijara CDC introduces two vehicles of ownership when it comes to your home through Ethical Finance and its corresponding utility tokens. Ethical Finance tokens help facilitate ownership for investors who purchase the property. Every month when lessees make their payment, they are rewarded with a subsidy of IJA tokens which they can use to interact within the Ethical Ijara ecosystem. Ethical tokens reflect the value of donations paid to the non-profit and can be converted to zETHi (Coming Soon: for a detailed description please refer to our staking guide in the Whitepaper).

By managing transactions through tokenization, an owner’s total value increases as the property value increases over time and both tokens can benefit from further increased value while being traded on liquidity markets.

What are Ethical Mortgages?

Understanding the Frictions:

Challenges with traditional mortgages

For years companies have attempted to manage complex mortgage transactions with antiquated technology and stagnated processing. Many large and small scale companies are selecting their targets within the mortgage pipeline to streamline the origination process. While their attempts have shown some level of success, very few of them innovate around and focus on the segment of consumers interested in Ethical mortgages due to its conflict with traditional systems tied to interest amortization and margins. In addition, several nuisances hold back the majority of these companies. A few of them are as follows:

1. Economics

Economic cycles sustain the ebb and flow of consumer economic prowess and we have met many of these cycles in our lifetimes. As of current, the US housing inventory is in a drought relative to demand; making it harder for consumers to achieve the dream of home ownership and prized asset appreciation. One of the flaws of traditional mortgage origination in today’s economy persists with the ever-present need for a down payment. In generations past, the down payment was a necessary evil to (a) give banks a signal that the borrower was creditworthy and (b) reduce the risk to the bank by lowering the amount it had to loan to the consumer. While risk is an unavoidable phenomenon, changes to the origination model need to occur today by eliminating the down payment as it is getting harder for the traditional consumer to amass, even in cases where the borrower has a worthy credit profile and consistent income stream.

2. Inflexibility

The US mortgage product seems incapable of absolving its dependency on interest rates. Mortgage products by and large have not catered to various segments of the population wanting to disassociate from borrowing interest rates for personal reasons. A few rent-to-own options have come to market recently but lack the experience in handling these transactions at scale. Moreover, these rent-to-own systems are still tied to fairly antiquated processes and do not capture the surplus opportunity for equity appreciation transferred to the owners until the property is sold or through another interest rate-based product such as a HELOC loan.

3. Consumer Liquidity Options

Traditional institutions have given homeowners the ability to take advantage of price appreciation through the use of HELOCs and/or their home sales. HELOCs offer owners the opportunity to tap into the equity appreciation of their home for a cost that is structured similarly to traditional mortgages. The other way for an owner to extract their appreciation is to sell the home and materialize the equity that has been built up over time. Both of these options come in handy to the consumer but these are fundamentally final and have their own limitations making them cumbersome at best.

- Since HELOCs are essentially mortgages on equity appreciation over time, consumers interested in Ethical mortgages would not consider the structure to increase their liquidity. Currently, there is a lack of options for these consumers to leverage their equity on their own terms.

- Once you sell your home, you capture the differential and have to start the appreciation process all over again. A dominant economic theory which holds true today is that asset appreciation increases relative to the amount of time it stays invested. Consumers today lose out on longer term investment horizons once they transition away from their home.

- Banks and financial institutions have notoriously been known for handling the sale of mortgages, packaged in tranches and sold as securities on the secondary market for decades. The result of which has made them flush with cash without the consumer harvesting any of the benefits.

4. Systemic Costs

As the mortgage pipeline is layered with substantial costs either through 3rd party fees, human capital and systems, those costs are passed through to the consumer. Most companies operating in the mortgage origination space process by way of inefficient systems which increases both the cost to maintain the system and the human capital to manage it. A by-product of these systems is obscurity, whereby the consumer does not have visibility into the inner workings of their data and how it is being used within these companies. Software as a service has fundamentally changed the landscape and in some cases for the better, yet; there are hundreds of vendor services that provide marginal improvement at best which companies still pay for and transfer the cost again to the consumer.

Tokenization of the cash flow in real estate transactions is our solution to this dilemma:

When Is The Launch

Ethical and Ijara are currently in Pre-launch. ETHi is now available on the Polygon Mainnet, the ETHi address is 0xf4584D3067Ce2f1C3C0779D91bb960678f8fF1dE and can be stored in a MetaMask Wallet. If you are interested in participating please reach out via email. and we can assist you in getting the token directly at pre-sale terms with lower transaction fees.

Why Buy At Pre-Sale

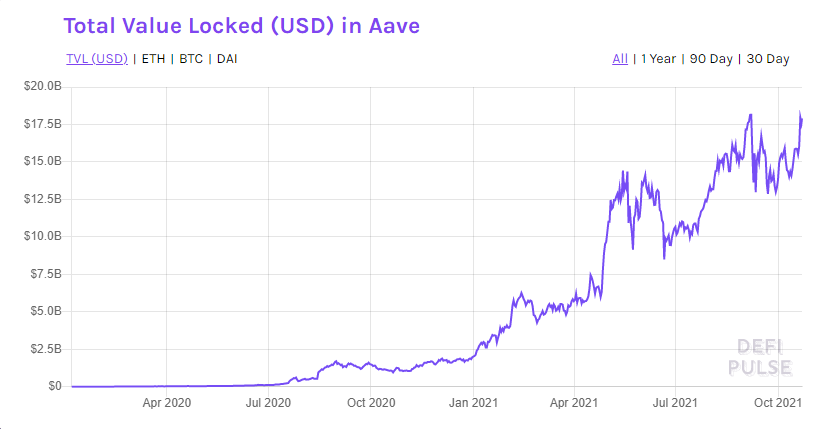

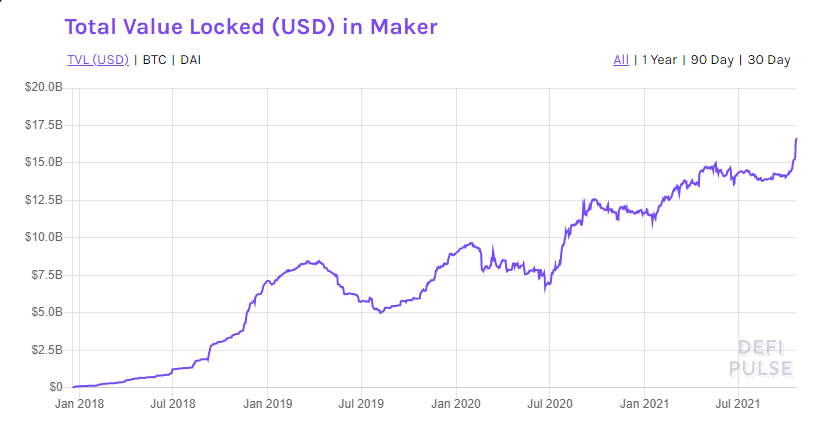

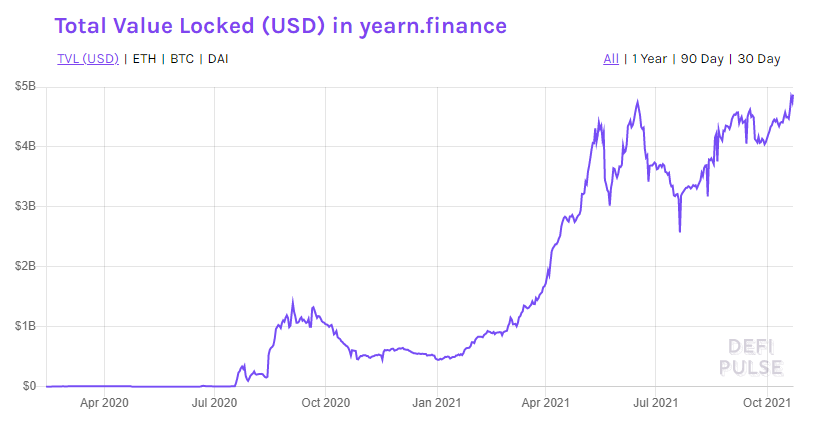

Buying before something becomes publicly available is sometimes a good strategy, there is always risk of course, but over the long term a viable project usually yields a good result. Take the following examples that we have been studying. the following charts can be found on DEFI Pulse:

Now we are not saying that our Tokens will have the same results, but a $10000 investment at the start of these projects in 2020 today (Oct 22,21) would be worth:

AAVE $80,693.67 Purchased 253.16455 shares at $39.5, as of Oct 22,21 it was trading at $318.74

MKR $57,845.14 Purchased 22.3974 shares at $446.48, as of Oct 22,21 it was trading at $2,582.67

YFI $378,920.50 Purchased 11.0253 shares at $907, as of Oct 22,21 it was trading at $34368.09

Marketing

We have several marketing strategies which include community development via Twitter, Tiktok, Discord, Facebook Reddit and other social media outlets. We have approached several influencers and will be able to announce some endorsements shortly.

We are currently developing our Mascot, Aly

Background

Problem/ #DECOM

Too many of us are unable to buy a home due to high home prices, stagnant wages, and strict mortgage approvals. We believe in leveling the playing field by making it possible to enjoy the benefits of owning a home sooner rather than later.

DECOM stands for Decentralized Common Sense. What exactly do we mean by that? Traditional mortgage financing employs a whole set of rules or guidelines that in the mortgage industry are referred to as Fannie Mae or Freddie Mac guidelines or Agency guidelines. These guidelines are designed to protect the respective agencies that are purchasing loans. In addition, other regulatory guidelines penalize institutions for not having “overlays”, which means if a lending institution is not being more strict than the Agency guidelines they may have to pay severe penalties including losing their lending licenses. This of course does not bode well for many consumers as they are not able to meet these strict requirements which often leads to predatory opportunists that offer very expensive rent to own programs that appeal to the home ownership goals of a consumer.

This is where #DECOM enters the picture. As an example, let’s suppose that a consumer is paying $1500 a month in rent for a 3-bedroom apartment and has been for the past 4 years, a new home purchase would reduce his payment to $1350, however, he does not make enough income to meet the Agency DTI ratio (Debt to Income) so he needs to continue to rent for $1500 a month and build zero equity. Though he can afford the payment and has demonstrated that he can make that payment, any Landlord would be happy to have him as a Tenant. This consumer is stuck in an endless cycle of remaining a Tenant with no hope of becoming a homeowner and securing his part of the American Dream. So using our philosophy of Decentralized Common Sense (#DECOM), we would be able to offer an affordable rent-to-own program, saving this customer $150 a month in rent payments, allowing them to acquire a home that they pick, whether it’s a single-family home with a yard or a Condo with no maintenance. And they would be able to choose participation in the appreciation of the real estate or the appreciation of the IJA token.

Existing Solutions

While there are are currently projects that are focusing on tokenizing Real Estate for investors, there are no projects promoting home ownership amongst individuals that are not able to participate in traditional home finance. Some of the non-traditional or alternative finance methods are structured as rent-to-own transactions but are very expensive solutions.

Our Solution

Our solution to solving the tokenization of real estate on the blockchain is the creation of the Ethical Token. It is well known that operating on the blockchain creates several benefits including visibility, immutability and recent advancements of speed to produce transactions without involving a third party. Another advantage in addition to the systemic benefits is the presentation of a store of value proposition through tokenizing transactions and allowing for the tokens to have a tradable surplus on various exchanges. While the tokens themselves can arbitrarily represent any form or function, tokens tied to physical assets and appreciation values offers stability which consumers can commoditize at their discretion. Mortgage value, specifically the Ethical mortgage value, is an ideal asset class to back a materialized token; harvesting increased appreciation and stable liquidity access relative to other tradable assets.

Fundamentally the structure of tokenizing Ethical mortgages offsets the main points in Understanding the Frictions as follows:

- Simplifying Economics

- The Ethical Product and Experience

- Power To The Consumer

- Reducing Costs

Tokenization of Cash Flow for the ETHi token holder via zETHi while providing a path to homeownership for the IJA token holder / Tenant Burning of the Token Supply with each Bonus distribution will increase the value of the remaining tokens.

Smart Contract Functions

The native token ETHi acts as a base layer smart contract token which is used to interact with other contracts in the Ethical Ijara Ecosystem.

NFTs

What is an NFT?

A Non-Fungible Token (NFT) is a one of a kind digital asset representing ownership that’s saved on a blockchain.

NFTs can represent ownership of virtually anything. So far, we’ve seen the technology adopted for:

- Art

- Collectibles

- Music

- Tickets

- Real Estate

- DAO Memberships

- Video Games

It’s still early and the use cases will continue to grow fast, but we believe strongly that a major use case will be applying real estate NFTs to transactions on the blockchain.

What Does Non-Fungible Mean?

Non-fungible means that the token is singular and cannot be replicated or replaced. The word fungible means replaceable.

What Does It Mean to Mint and Burn an NFT?

To mint is to create. Minting an NFT means publishing the digital contract onto a blockchain, making it “non-fungible.” To burn is to destroy. The NFT is removed from supply from the blockchain.

What is the Floor Price?

The floor price is the lowest price for an NFT in a given project.

Gas Fees

Gas is the fee required to transact on Polygon. Buying an NFT, accepting an offer, transferring an NFT, canceling a listed NFT, or canceling a bid all require gas.

Polygon is one of the most commonly used blockchains for NFTs. Layer-2 solutions such as Polygon are used to mitigate high gas fees for transactions. Ethical plans on using Polygon for our users to transact cheaply and safely.

Why Can’t I Just Right Click And Save?

You can. However, that doesn’t mean you own the NFT. The difference between saving the image of a digital representation and being able to interact with that digital product are two different things. Ownership of the NFT is similar to owning an original piece of artwork versus owning a print.

The owner and artist may love for the art to be shared as much as possible. The more popular, the more valuable the underlying token represented by the NFT.

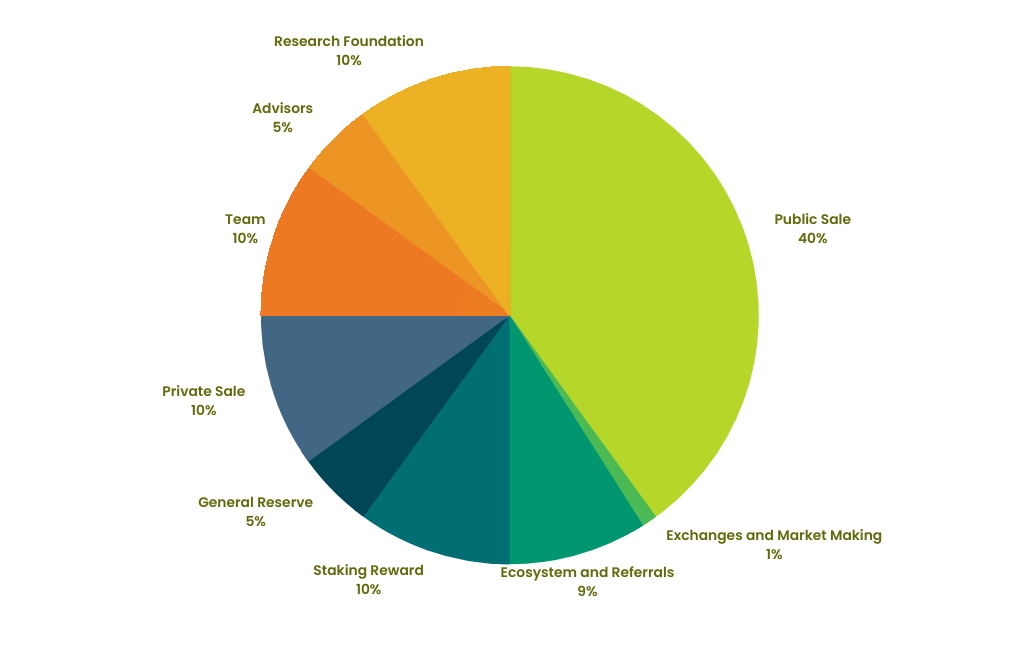

Anticipated Final Distribution of Tokens

49% of tokens held by Treasury

Anticipated Final Distribution of 51% of Tokens

TEAM

Shoeb Sharieff

Shoeb enjoys an extensive background in real estate and business development. A graduate of the University of Michigan with a Bachelor of Science Degree, Shoeb is experienced in financial services and has considerable information technology skills which are helping the IJARA™ program become more consumer-friendly through the appropriate application of technology. Shoeb is also well-versed in both Residential and Commercial Lending, and serves as the President and CEO of www.ijaraCDC.com, Ijara Payment Processing, and Ijara Capital.

Conclusion

In a fast-paced world that is constantly changing,